Hi everyone,

This week, I tested Claude’s new spreadsheet creation feature — and the results honestly stunned me. Until now, AI-built spreadsheets were messy at best. But Claude just crossed a quality threshold that makes this a game-changer for CFOs and finance teams.

📢 Upcoming Events for Finance Leaders – Save the Dates!

AI Finance Club remains my favorite community for finance leaders exploring AI. If you’re not part of it yet, you’re missing out on some of the most practical, no-hype conversations about how finance teams can actually use AI.

I’m an expert in the Club — every month, I host the Fractional CFO Corner, a dedicated workshop for fractional CFOs. It’s a great way to see me regularly, share challenges, and learn hands-on AI strategies together.

Don’t miss the live session on how AI is reshaping the CFO role and the tools top finance leaders are already adopting by Nicolas Boucher, the leader of the community!

When: Friday, September 26, 2025 | 11:00 AM ET / 5:00 PM CET

Seats are limited—grab yours now!

The Balanced View: Claude’s Spreadsheet Power in Action

I’ve been testing AI solutions for over two years now, and spreadsheets have always been the weak spot. LLMs excelled at drafting text, generating code, and analyzing data — but they consistently failed in creating Excel models.

Even today, if you ask most AI tools (including ChatGPT) to create an Excel file for you, the results will be mediocre at best: broken formulas, poor formatting, and nothing close to CFO-ready output.

Claude just changed that.

When I tested its new file-creation capability, it built three finance models that I’d normally spend hours producing. With Claude, I had working drafts in under 3 minutes, and then spent about 20 minutes fine-tuning.

These are first, basic attempts, but they already look very good. With a little more effort (tweaking layouts, assumptions, formatting), you can turn them into high-quality results tables.

Currently, this functionality is available to select tiers of Claude, including Max, Team, and Enterprise, which are now in preview. Pro users will get access in the coming weeks.

Here are the use cases I tested:

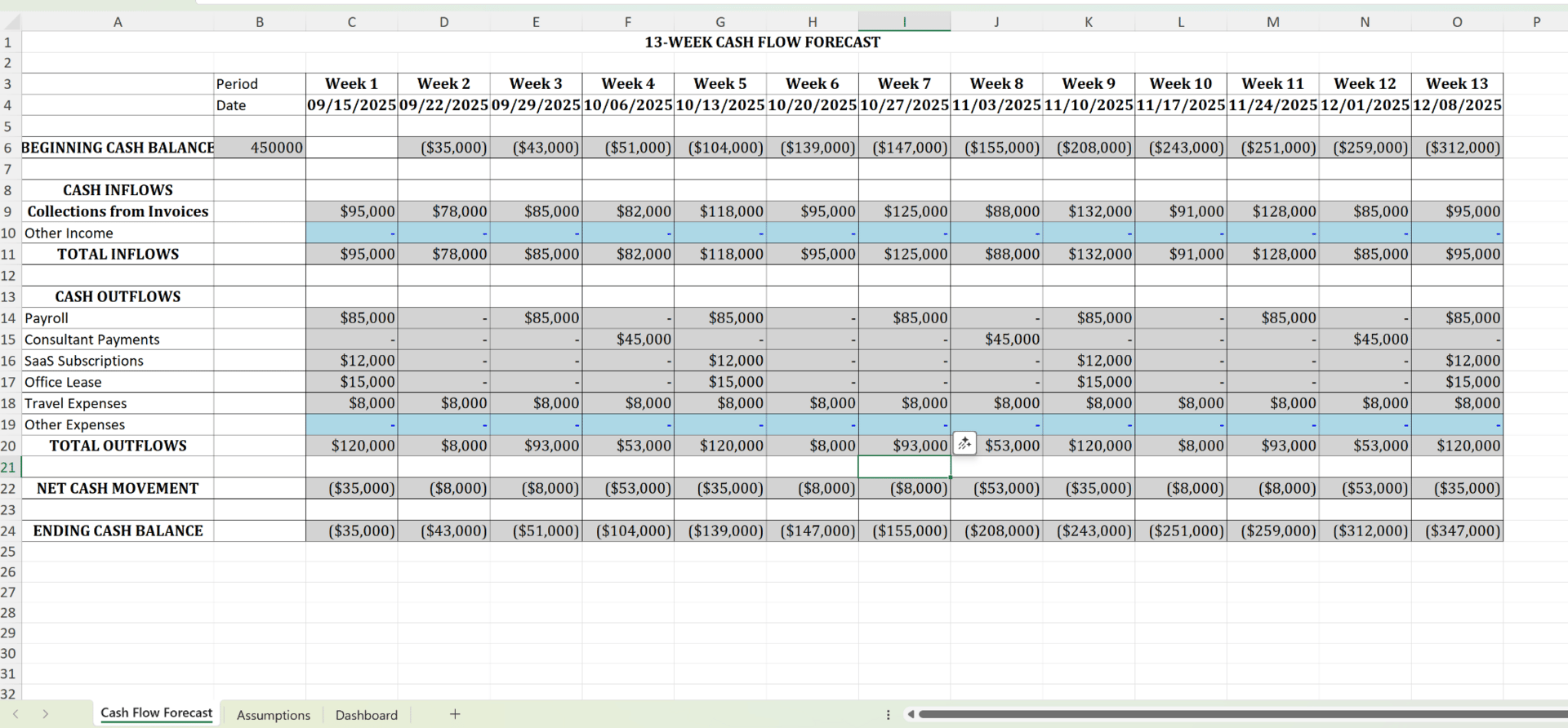

1. 13-Week Cash Flow Forecast (Professional Services)

Prompt I used:

"Create a 13-week cash flow forecast in spreadsheet format for a U.S. professional services firm.

Details: Revenue comes from client invoices issued bi-weekly, with payment terms ranging from net-15 to net-60. Major expenses are payroll (bi-weekly), consultant payments (monthly), SaaS subscriptions, travel, and office lease.

The spreadsheet should include:

Weekly columns for 13 weeks

Rows for beginning balance, inflows, outflows, and ending balance

Breakdown of inflows (collections by week) and outflows (payroll, consultants, subscriptions, travel, lease)

A summary row for net cash movement per week

Color coding: input cells (assumptions) in light blue, formula cells in light gray

Dashboard tab: key charts showing weekly ending cash balance trend, total inflows vs outflows, and cash runway"

Feedback: Claude created a solid rolling forecast, linked correctly across weeks, and charted the ending cash balance. That’s not a super complex task, but building this dashboard from scratch, linking cells, and adding color coding would normally take about an hour. Claude did it in 5 minutes.

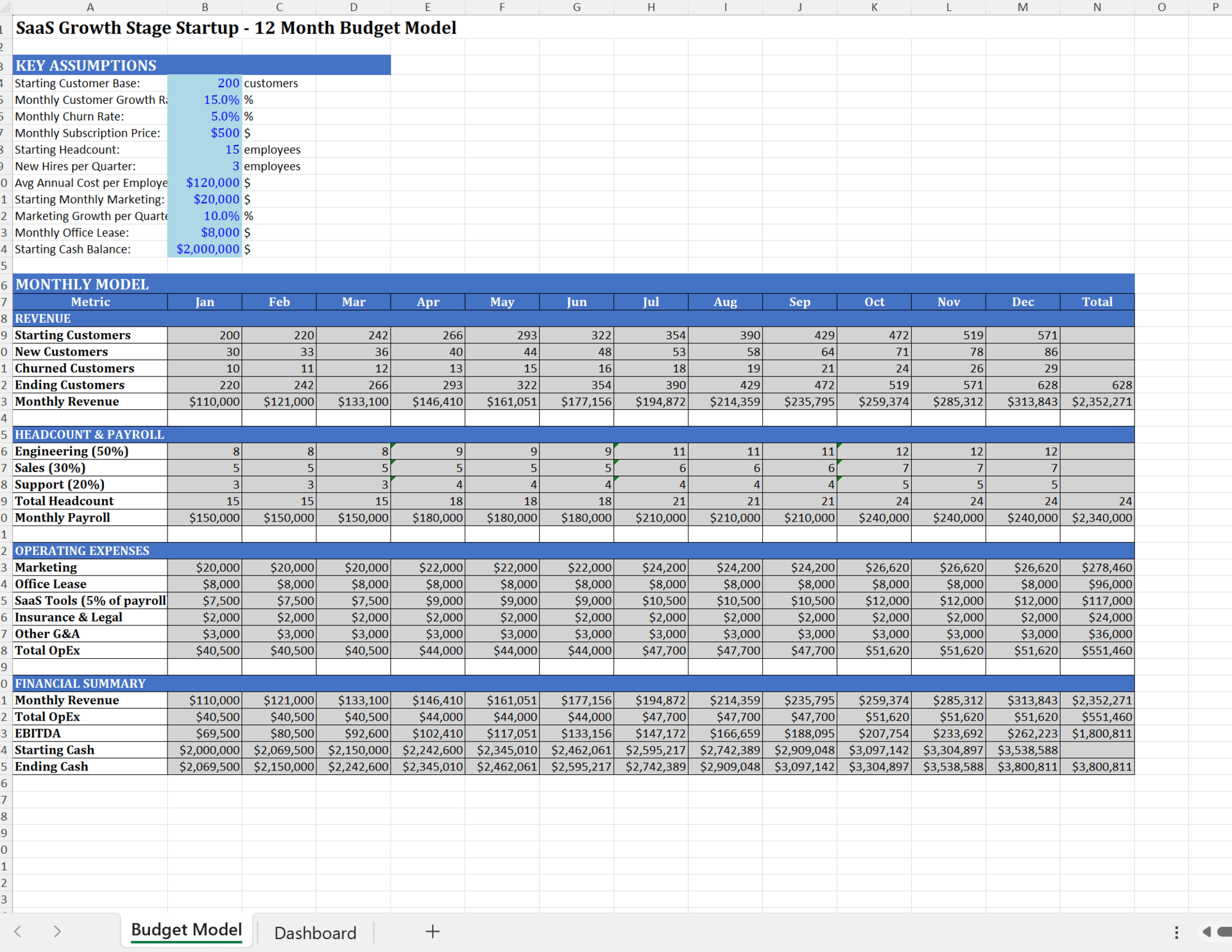

2. Budget Model for a Growth-Stage SaaS Startup

Prompt I used:

"Create a 12-month budget model in spreadsheet format for a SaaS growth-stage startup.

Details: The company sells a B2B SaaS product at $500/month per customer. Current customer base is 200, growing at 15% monthly. Churn is 5% monthly.

Headcount: 15 employees today, hiring 3 new people per quarter (mix of engineering, sales, and support). Average fully-loaded cost per employee is $120k/year.

Marketing spend: $20k/month, scaling by 10% each quarter.

Office lease: $8k/month.

The spreadsheet should include:

Monthly revenue projections

Headcount by department with payroll cost roll-up

Operating expenses by category (marketing, lease, SaaS tools, etc.)

EBITDA line

Ending cash balance, assuming $2M starting cash and no new funding

Color coding: input cells (assumptions) in light blue, formula cells in light gray

Dashboard tab: charts showing revenue growth, expense breakdown by category, headcount trend, and cash balance."

Feedback: It wasn’t perfect. There were some mistakes in the formulas, and the dashboard needed some work, but overall, it's a solid basis that I can take and tweak to get a perfect result. In the real world, I would definitely start with the Claude-produced model instead of creating the first draft myself.

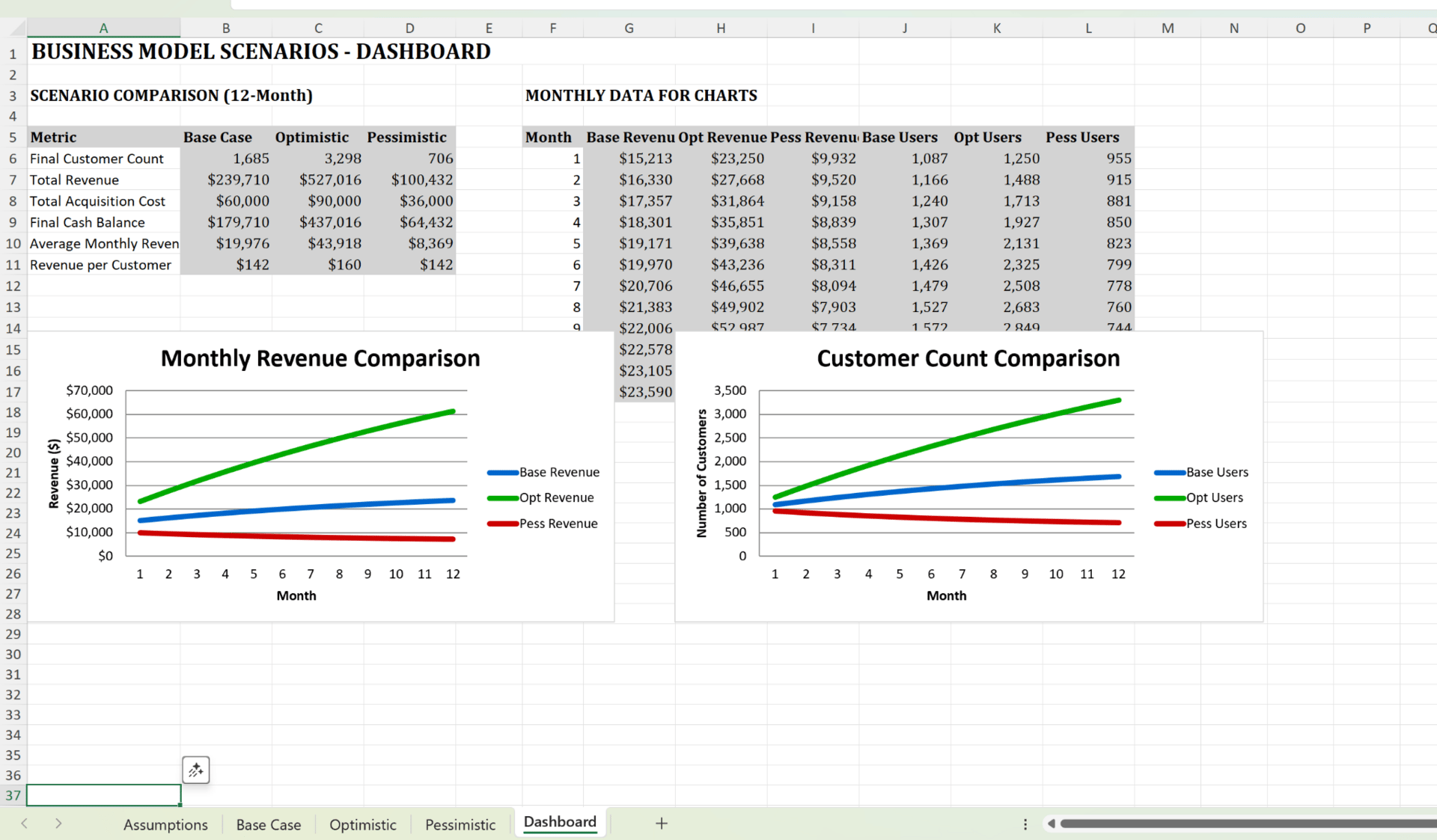

3. Business Model Testing for an Early-Stage Startup

Prompt I used:

"Create a spreadsheet for testing different business model scenarios for a new consumer subscription startup.

Details: The startup offers a wellness app with a $15/month subscription. Initial user base: 1,000. Potential pricing tiers: $10 basic, $15 standard, $25 premium.

Customer acquisition cost (CAC): $30. Churn rate: 8% monthly. Monthly marketing budget: $5,000.

The spreadsheet should include:

Assumptions tab for pricing tiers, churn, CAC, and marketing spend

Revenue projections by tier

Customer acquisition and churn model

Cash flow projection for 12 months under different pricing and churn assumptions

A dashboard view comparing scenarios (base case, optimistic, pessimistic)

Color coding: input cells (assumptions) in light blue, formula cells in light gray

Dashboard tab: visual comparison of scenarios with charts for revenue, customer count, and ending cash balance"

Feedback: Claude created three scenario cases based on assumptions that I can easily adjust. All links work correctly. The formulas make sense. I’m very impressed.

The Bigger Picture: Threat or Opportunity?

Here’s the hard truth: if your current job is building cash flow models, budgets, or scenario spreadsheets manually, AI is coming straight for that work.

Threat: Clients and managers won’t pay $1,000 for a model when AI can draft the first version instantly. If you don’t adapt, you’ll be outpaced.

Opportunity: If you do adapt, you can deliver more value. The real work shifts from number-crunching to interpreting results, advising strategy, and guiding decision-making.

This is the new divide in finance: those who leverage AI, and those who get displaced by it.

Deeper Dive: 5 More Claude Use Cases Every CFO Should Try

Here are five additional spreadsheet workflows Claude can now handle — all tasks that used to eat hours of finance time. Copy these prompts to test them yourself:

✅ Variance Analysis (Budget vs Actuals):

"I have a CSV file with monthly budget vs. actual results. Create a variance analysis spreadsheet with percentage and dollar variances, highlight variances >10%, and produce a dashboard with charts showing revenue and expense deviations."

✅ Consolidated Financial Statements (Multi-Entity):

"I have CSV exports of trial balances for three subsidiaries. Build a consolidated financial statement (P&L and balance sheet), eliminate intercompany transactions, and provide both entity-level and consolidated views. Color code assumptions and create a dashboard with consolidated margins and cash balances."

✅ KPI Tracking & Dashboard:

"Create a monthly KPI tracker spreadsheet for a SaaS company with 5,000 customers. Metrics should include MRR, ARR, CAC, churn, LTV, gross margin, and net revenue retention. Add color-coded input cells for assumptions (CAC, churn) and a dashboard with trend lines for each KPI."

✅ Board Meeting Pack Prep:

"I have a CSV file with monthly revenue and expense data. Create a board-ready spreadsheet with three tabs: (1) P&L summary with % of revenue, (2) cash runway forecast based on current burn, (3) charts for revenue trend, expense breakdown, and net income."

✅ Investment Scenario Testing:

"Build a spreadsheet comparing three fundraising scenarios: raising $2M, $5M, or $10M. Each scenario should show cash runway, headcount capacity, and revenue potential over 24 months. Include an assumptions tab (spend rates, hiring plans), color-coded inputs, and a dashboard comparing the three cases."

Think of Claude as taking care of the heavy lifting. The hours you save on spreadsheets can now be redirected toward higher-value work — shaping scenarios, advising on funding, and preparing insights your board actually needs.

Closing Thoughts

After two years of testing AI tools, this is the first time I’ve seen CFO-grade spreadsheets generated this fast and this clean.

The takeaway: our value is shifting from manual model-building to interpretation, scenario design, and decision support. That’s where we’ll win.

If you want to see the real outputs, I’m happy to share the spreadsheets that Claude created for me. Reply to this email (or email me directly) and I’ll send the files so you can judge the quality yourself.

We Want Your Feedback!

What topic would you like me to cover next?

This newsletter is for you, and we want to make it as valuable as possible. Please reply to this email with your questions, comments, or topics you'd like to see covered in future issues. Your input shapes our content!

Want to dive deeper into balanced AI adoption for your finance team? Or do you want to hire an AI-powered CFO? Book a consultation!

Did you find this newsletter helpful? Forward it to a colleague who might benefit!

Until next Tuesday, keep balancing!

Anna Tiomina

AI-Powered CFO