In this edition, we're diving deeper into one of the most accessible yet powerful ways to implement AI in your finance operations: leveraging AI features embedded in the software you're already using. Many finance departments are finding that activating these existing AI capabilities is a pragmatic first step on the journey to AI adoption. However, as practical as this sounds, navigating the landscape can be far from straightforward.

This week, I'm excited to announce that my article on 'How to Automate Reports Using AI' will be published in AI Finance Club. I use a Quarterly Investor Report as an example, explore tools like Claude, ChatGPT, and Perplexity, and give step-by-step instructions on how to use these tools effectively.

I highly recommend joining the club if you're interested in keeping your AI knowledge fresh and updated.

The Balanced View: AI in Your Existing Tools

Software providers are rolling out AI features in tools such as ERP systems, accounting platforms, and financial planning software, but the journey to unlocking these features isn’t always easy. Why? One of the key challenges is that the support teams for many of these software providers aren’t fully equipped to guide users effectively. The AI components often feel like a side feature—underpromoted, under-explained, and sometimes hidden beneath layers of functionality. This can make it challenging for finance professionals to understand how to activate and leverage these AI tools for maximum benefit.

However, the rapid development of these AI features is undeniable. While the pace might seem slower compared to generic AI tools like ChatGPT, it’s still incredibly impressive, especially when considering the conservative nature of many financial software products. Many ERPs, accounting solutions, and budgeting tools are moving toward incorporating more advanced AI capabilities, ranging from smart financial insights to automating routine entries. This evolution might not come as fast as AI-native products, but it's gaining momentum steadily, and the impact is already significant.

A major factor in leveraging the AI features in existing software as a first step is that companies don't need to be overly concerned about data safety and security because the software providers have it covered. Most reputable financial software vendors have built-in security measures and compliance protocols, ensuring that sensitive data is handled with care. This means that when finance teams activate AI capabilities within these platforms, they can trust that the provider has already addressed critical security and regulatory concerns, allowing teams to focus on the efficiency and insight benefits of AI rather than worrying about data breaches or compliance issues.

AI Capabilities in Finance Software: What’s Available and What’s Coming

Let’s take a closer look at some of the existing AI functionalities in finance-specific software that can bring immediate efficiency gains to your operations:

ERP Systems (e.g., Oracle NetSuite, SAP, Microsoft Dynamics 365)

Many ERPs now feature built-in AI-powered analytics that automatically detect anomalies in financial data, flagging potential issues before they become major problems. These tools can also generate predictive insights for cash flow, inventory management, and demand forecasting, enabling more informed decision-making.

Accounting Platforms (e.g., QuickBooks, Xero, Sage Intacct)

AI in accounting platforms is primarily focused on automating data entry, categorizing expenses, and reconciling bank statements. Xero, for example, uses AI to suggest coding for transactions based on historical data, while Sage Intacct has introduced smart reporting tools to generate insights on financial performance.

Budgeting and Forecasting Tools (e.g., Workday Adaptive Planning, Zoho Books)

AI features in budgeting software are designed to improve forecasting accuracy by using historical data to predict future financial trends. Some tools can even simulate different financial scenarios based on user-defined inputs, helping finance teams anticipate the impact of various strategic decisions.

It’s not just the most forward-thinking solutions that are getting on board. Even the most traditionally conservative software providers—those who have largely remained AI-agnostic—are now actively looking into how to incorporate AI in some capacity. Whether it's through automating audit trails or providing smart suggestions for reducing operational costs, the intent is clear: AI is becoming an integral part of finance software.

Overcoming Challenges to Realize Value

So, how can finance professionals navigate these emerging AI capabilities effectively, especially given the lack of comprehensive guidance from software vendors? Here are some practical tips:

Be Proactive: Don’t wait for your software provider to explain AI features to you. Take the initiative to explore the tools on your own or with your team. Many vendors provide webinars, online tutorials, and documentation—use these resources to understand what's possible.

Invest in Training: Often, a lack of awareness is what keeps teams from using AI effectively. Training your finance team on the basics of AI, and how it specifically applies to the software they’re using, can be a game-changer. Programs like my AI Blend Workshop are designed to help finance teams demystify these technologies and put them to use quickly.

Start Small: Start by activating and experimenting with the simplest AI features available—such as automatic expense categorization or AI-generated reports—to build confidence before moving on to more complex functions.

Hire a Consultant: If navigating AI features feels overwhelming or if your team lacks the bandwidth to explore these tools effectively, consider hiring a consultant. A knowledgeable consultant can help identify the most valuable AI opportunities in your existing software, provide training, and guide your team through implementation. This can significantly reduce the learning curve and ensure that you're getting the most out of your software's AI capabilities.

Leveraging AI features in your existing software might seem like a small step, but it’s one that can yield significant time savings, reduce errors, and provide more timely insights into your organization’s financial health. As these AI capabilities continue to evolve, those who begin exploring them today will be well-positioned to take full advantage of the next wave of AI advancements in finance.

Ask the AI CFO

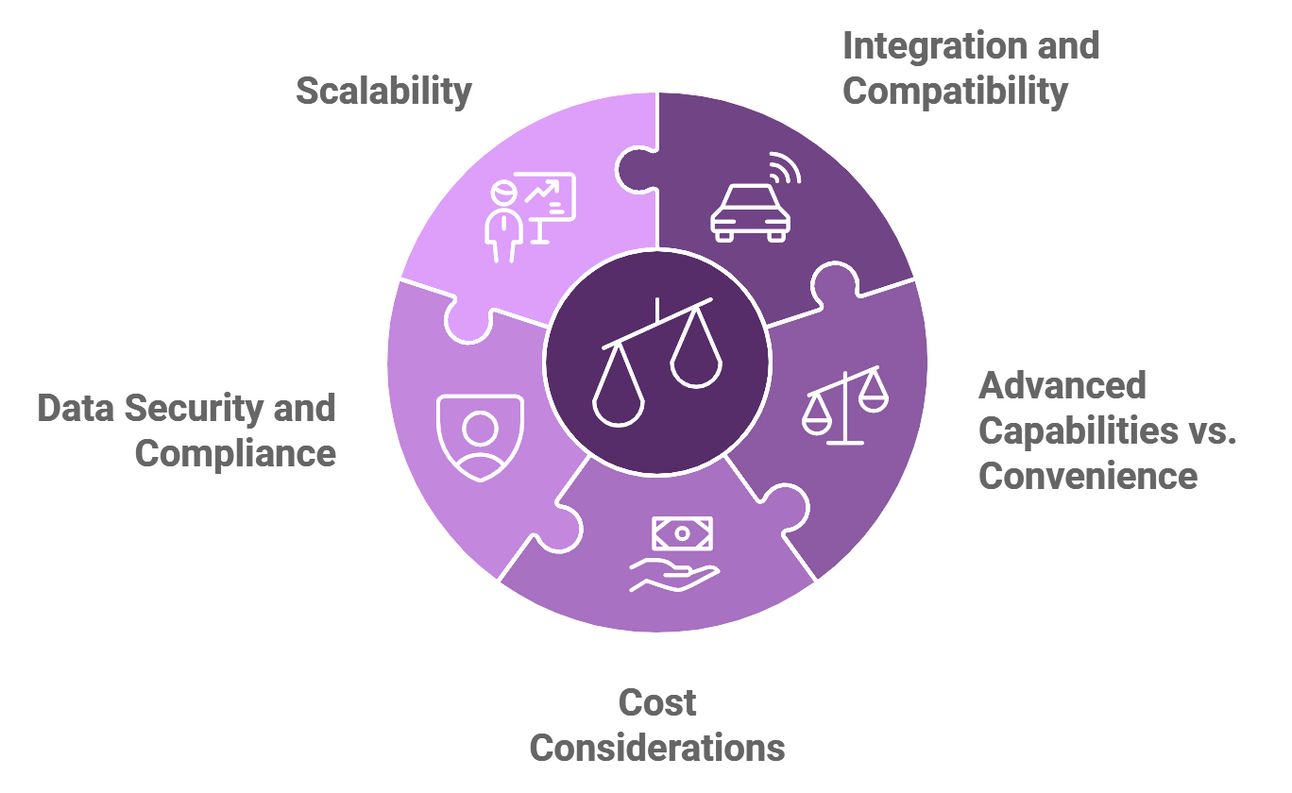

Question: I am choosing between a specific AI software built on top of my existing software and the same feature inside the existing software. How do I make the right decision?

Answer: Let’s use an example—consider Accounts Payable (AP) automation for your finance team.

Integration and Compatibility: If you use an ERP system like SAP or Oracle NetSuite, the built-in AI features integrate seamlessly, making them easy to implement without extra setup. Specialized solutions, like Tipalti, may require custom connectors or middleware to integrate well. If ease of use is your priority, the built-in option is a clear winner.

Advanced Capabilities vs. Convenience: A specialized tool like Hyperbots offers advanced capabilities such as enhanced fraud detection, better supplier management, and customizable workflows—features that built-in ERP options might lack. If your AP needs are complex, specialized AI tools could be more suitable. For general automation needs, the built-in features are likely enough.

Cost Considerations: Built-in AP automation is typically included in your ERP subscription cost, whereas specialized solutions like Hyperbots come with additional subscription fees. Weigh the extra functionality against its cost—only go with specialized software if it adds significant value.

Data Security and Compliance: Built-in AI features rely on your ERP's existing security measures, reducing the burden of managing data compliance. Specialized AI software may require extra due diligence to assess its security protocols, which could mean more work for your team.

Scalability: Specialized tools like AvidXchange are often designed with scalability in mind, making them ideal if your AP operations are set to grow. Built-in ERP features may have scalability limits, so consider your long-term needs.

Conclusion: If you need a solution that is easy to integrate, cost-effective, and secure, stick with your ERP's built-in AI features. However, a specialized AP solution might be the way to go if your team requires advanced capabilities, customization, and scalability.

Tip of the Week: AI-Driven Email Automation for Finance Teams

Did you know that AI can help you automate everyday email tasks, making communication faster and more efficient? Tools like Microsoft Outlook and Gmail have AI-powered features such as Smart Reply and AI-generated email drafts, which can significantly reduce the time spent on repetitive email correspondence.

For example, finance teams often deal with routine inquiries—such as questions about invoice statuses or requests for financial reports. Using Smart Reply, you can quickly select from suggested responses, saving time and ensuring consistency in your replies. Additionally, AI-generated email drafts can help you craft more complex responses. By typing a few key phrases, the AI can complete the email for you, allowing you to focus on more critical work rather than drafting repetitive messages.

Here’s a step-by-step guide on how to use these AI features effectively:

Step 1: Set Up AI Features in Your Email Client

Microsoft Outlook: Ensure you have the latest version of Outlook. Go to Settings, select Mail, and enable Suggested Replies.

Gmail: Make sure Smart Reply and Smart Compose are turned on. Go to Settings > General, and scroll down to enable these features.

Step 2: Use Smart Reply for Quick Responses

When you receive an email that requires a simple reply (e.g., "Can you confirm the receipt of the invoice?"), look at the bottom of the email for the suggested responses.

Select the appropriate response, such as "Yes, I confirm receipt." You can edit the reply if needed, then hit Send.

Step 3: Draft Emails Using AI-Generated Suggestions

When composing a new email, start by typing a few key phrases, like "Attached is the Q3 financial report you requested."

AI tools like Smart Compose will offer suggestions to complete the email. Use the Tab key to accept suggestions as they appear.

For longer, more complex messages, write a brief outline or key points. Let the AI generate a more polished draft, which you can then tweak for accuracy and tone.

Step 4: Automate Routine Follow-Ups

For repetitive emails, like requesting missing documents or confirming receipt of information, consider drafting a template and using AI to personalize it.

Start typing the beginning of your template, and let AI suggest the rest based on the context. This makes routine follow-ups quick and easy.

Step 5: Maintain Consistency with AI Tools

Ensure that your replies and drafted emails maintain a consistent tone by training the AI on your preferred style. When prompted with suggestions, choose those that align with your team's communication style.

Step 6: Review and Optimize

After implementing AI-driven email features, review your workflow after a few weeks to identify any areas for further optimization.

Gather feedback from your finance team to see if AI tools are helping and make adjustments accordingly.

Implementing these small AI tools into your daily workflow can have a noticeable impact on productivity, enabling your team to spend less time on routine communication and more time on strategic initiatives.

Closing Thoughts

As finance teams navigate the world of AI, leveraging the features in existing software can be one of the most effective ways to get started. Whether you are tackling routine tasks, unlocking insights, or improving communication, these built-in tools can provide significant value with minimal disruption. If you're looking for more hands-on support, consider joining my AI Blend Workshop—a 4-hour session designed to help finance teams demystify AI and achieve immediate efficiency gains.

We Want Your Feedback!

This newsletter is for you, and we want to make it as valuable as possible. Please reply to this email with your questions, comments, or topics you'd like to see covered in future issues. Your input shapes our content!

Want to dive deeper into balanced AI adoption for your finance team? Or do you want to hire an AI-powered CFO? Book a consultation!

Did you find this newsletter helpful? Forward it to a colleague who might benefit!

Until next Tuesday, keep balancing!

Anna Tiomina

CFO & AI Enthusiast