Every year I plan a Christmas vacation. And every year, I discover critical year-end items that need attention before I can actually leave the office.

Year-end close meant days of manual work hunting for timing issues, building cash projections, documenting everything for auditors. The work had to be done, and it had to be done by you, and it had to happen in December.

In 2025 it should be different! AI can save those precious hours that we can spend with our families and friends instead.

This edition covers two workflows: year-end accruals analysis and AR cash forecasting.

My hope is that more CFOs can actually take time off this December. Let's see if we can make that happen.

Two Year-End Tasks CFOs Can't Afford to Rush

December is when finance teams discover exactly how much manual work still lives in the year-end close process.

These tasks are necessary. They're also time-consuming, detail-heavy, and prone to human error when you're rushing. The underlying work is pattern recognition and scenario modeling. Which means it's exactly the kind of work AI handles well.

Year-End Accruals

Year-end accrual analysis used to mean scrolling through P&L data transaction by transaction, flagging irregular patterns, calculating what should have been recognized when, drafting journal entries, documenting your rationale for each adjustment. Days of focused work, often interrupted by other year-end priorities.

There's a faster way: upload your P&L or transaction details to an LLM. Add business context (industry, typical expense structure, known timing issues). AI spots timing inconsistencies you might miss—the account that shows expenses in 10 months but not 2, the quarterly pattern that's off by a month, the annual renewal that should be amortized. It flags accounts that typically require accruals, identifies seasonal anomalies, proposes specific journal entries with calculated amounts and supporting rationale.

The CFO still validates every recommendation. But the pattern detection and calculation work is done in hours instead of days.

A client of mine, a mid-sized device reseller, used this approach for their year-end close. They uploaded expense transaction details, shared business context (known timing issues like quarterly insurance payments, contractor invoice patterns, seasonal Q4 volume spikes), and used this prompt:

"Please analyze monthly patterns in this P&L and identify accounts with inconsistent timing, accounts that typically require accruals (contractors, insurance, freight, professional fees), months where amounts appear understated or missing, seasonal or irregular spikes that should be smoothed, and any potential cutoff issues. For each issue found, propose specific journal entries with calculated amounts and supporting rationale."

Time investment: 2 hours of focused work. The CFO validated every recommendation and adjusted based on business judgment, but the pattern hunting and documentation drafting was handled.

Result: More thorough analysis (AI doesn't get tired or miss patterns) in less time, with better documentation.

Cash Planning Scenarios

Another heavy year-end task is cash planning. Companies with large clients know the pattern: expect either unusually early or unusually late payments depending on how those clients manage their own year-end cash flow. Which means you need to manage yours—constantly monitor your bank account, have tax buffers and prepayments ready if collections come in early, or have a credit line and payment delay strategies ready if collections run late.

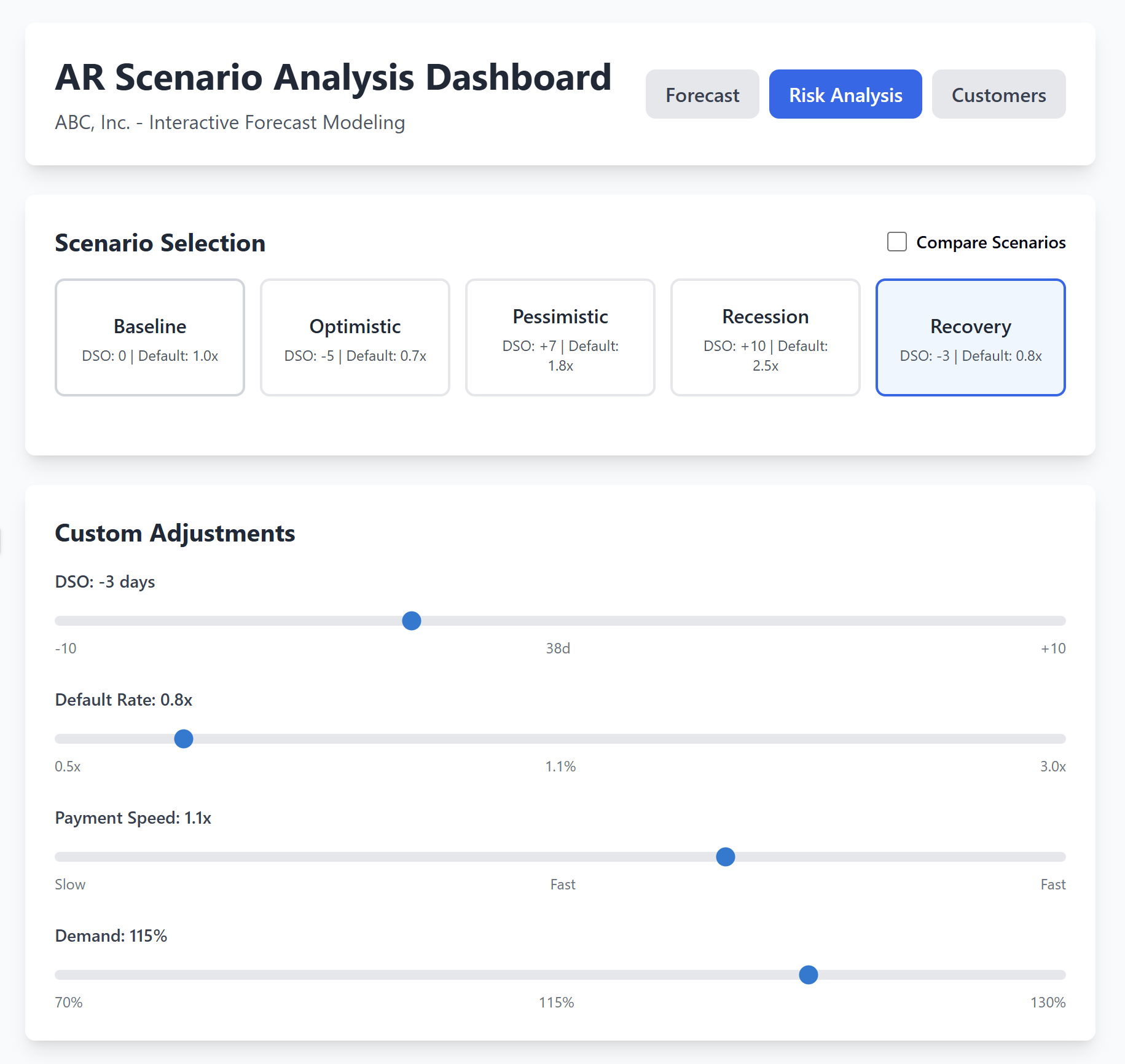

AI helps here too: you can build risk-adjusted projections, scoring customers by collection risk using lateness patterns, invoice concentration, and payment history. It generates week-by-week cash projections and creates interactive dashboards where you adjust DSO assumptions, default rates, or seasonal factors and see the impact instantly.

What used to require rebuilding spreadsheet formulas now happens with slider adjustments in real time.

The same company needed an 8-week cash projection heading into the holiday slowdown. Standard 30-day payment terms, but December typically sees payment delays. Large customer concentration creates collection risk that affects cash planning.

Here's what they did: uploaded aging report with business context (payment terms, typical DSO, seasonality factors, concentration risk). Ask the LLM to build an interactive dashboard:

"Please analyze this AR aging and create an interactive dashboard that shows: weekly cash collections projection for the next 8 weeks, customer-level risk scoring (low/medium/high) based on lateness and invoice size, and adjustable sliders for DSO (+/- 10 days), default rate assumptions, and seasonal payment delays. Update all projections dynamically as I adjust the assumptions."

Time investment: 30 minutes to build the initial forecast, then real-time scenario testing. The CFO tested multiple assumptions interactively—optimistic holiday impact, pessimistic customer behavior, realistic mid-case—without rebuilding anything.

Result: Risk-adjusted cash forecast with documented scenarios, completed in a fraction of the time with more scenarios tested.

The speed difference matters, but the quality improvement matters more: better pattern detection, more scenarios tested faster, clearer documentation of assumptions for audit purposes.

What to Do (and What Not to Do)

Do validate every recommendation. AI produces analysis and proposals, not final answers. Every proposed accrual needs CFO review for business reasonableness. Every cash projection requires professional judgment about customer behavior and seasonal factors. Material adjustments require discussion with your CPA before booking.

Do provide specific business context. AI needs your industry knowledge, expense structure, payment terms, and seasonal patterns to produce useful analysis. Generic prompts produce generic results. Specific context (quarterly insurance timing, contractor payment patterns, December holiday slowdowns) produces specific, actionable recommendations.

Do test the workflow before automating. Run these analyses in a regular chat window first. Validate the output quality. Refine your prompts based on your business. Only after you've confirmed everything works should you consider building a custom GPT or project for next year's repeatability.

Don't skip documentation. For audit purposes, document what context you provided, which recommendations you accepted versus modified, and your business rationale for any changes. AI-assisted analysis still requires a clear audit trail showing CFO judgment and oversight.

Don't treat output as final without review. These are decision support tools. The analysis requires a finance professional who understands the business, knows what adjustments make sense, and can explain the rationale to auditors or tax preparers.

Don't ignore red flags. If a proposed accrual doesn't match vendor invoice patterns, investigate. If a cash projection ignores known customer payment issues, adjust. AI pattern recognition is good, but it doesn't know everything about your specific business relationships.

We've covered what AI can do for year-end accruals and cash forecasting: faster pattern recognition, better risk scoring, interactive scenario modeling that used to require manual spreadsheet work.

Of course, in real life one prompt rarely gives you high-quality output on the first try. A better approach is using a prompt sequence—a structured conversation with checkpoints where you validate AI's understanding before moving to the next step.

In the subscriber-only section, you'll get two complete prompt sequences: a 10-step workflow for year-end accruals and a 3-step workflow for AR forecasting. Each includes exact prompts, what to validate at each checkpoint, and tips for better output quality. If you're facing year-end close this month, these workflows could save you 15-20 hours while improving accuracy.

Closing Thoughts

This used to be the time of year when finance professionals resigned themselves to working through the holidays. Now we have tools that can handle the heavy lifting on pattern recognition and calculations.

I'm grateful to help more finance teams save time on year-end close. If these workflows work for you, let me know—I'm always curious what succeeds in real environments, not just in theory.

Taking a break after this edition. Back in January with fresh insights. Until then, here's to a smooth close and an actual vacation.

Anna

We Want Your Feedback!

This newsletter is for you, and we want to make it as valuable as possible. Please reply to this email with your questions, comments, or topics you'd like to see covered in future issues. Your input shapes our content!

Want to dive deeper into balanced AI adoption for your finance team? Or do you want to hire an AI-powered CFO? Book a consultation!

Did you find this newsletter helpful? Forward it to a colleague who might benefit!

Until next Tuesday, keep balancing!

Anna Tiomina

AI-Powered CFO

1